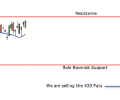

We already have a credit call spread in our position for AAPL but the Bullish Engulfing pattern that showed up today got my attention. Last week we sold the 500/510 call spread in October which means we want the stock to stay below 500 by next Friday. The engulfing pattern is threatening that position so I thought it would be a good idea to sell the November 430/400 put spread to take in a small credit just in case we have to close out of the call spread early. The video will explain more.